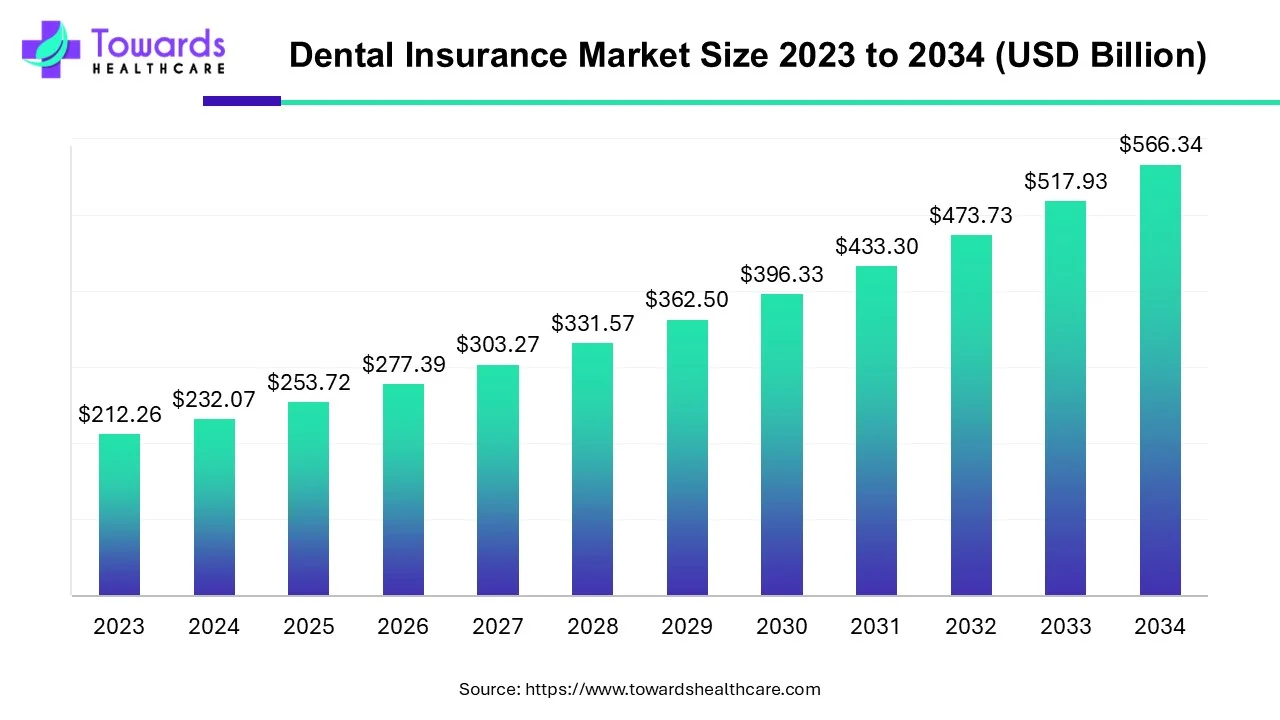

Dental Insurance Market 2025 Valued at USD 253.72 Bn is Projected to Surpass USD 566.34 Bn by 2034

The global dental insurance market size is calculated at USD 253.72 billion in 2025 and is expected to reach around USD 566.34 billion by 2034, growing at a CAGR of 9.33% for the forecasted period.

Ottawa, July 23, 2025 (GLOBE NEWSWIRE) -- The global dental insurance market size was valued at USD 232.07 billion in 2024 and is predicted to hit around USD 566.34 billion by 2034, a study published by Towards Healthcare a sister firm of Precedence Research.

Get a free sample of the Dental Insurance Market report for key insights and market overview: https://www.towardshealthcare.com/download-sample/5471

Key Takeaways

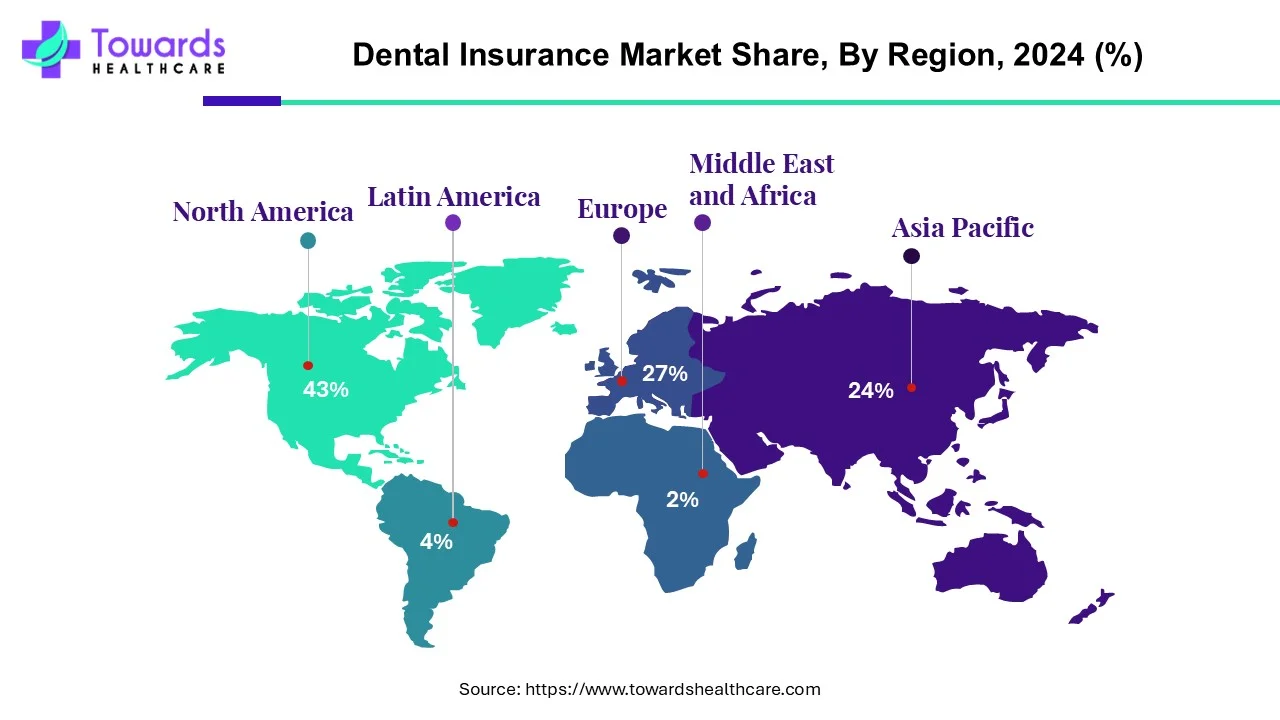

- North America dominated the global dental insurance market share by 43% in 2024.

- Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By coverage, the dental preferred provider organizations (DPPO) segment held a dominant presence in the market in 2024.

- By coverage, the dental health maintenance organizations (DHMO) segment is predicted to witness significant growth in the market over the forecast period.

- By type, the preventive segment held the largest share of the market in 2024.

- By type, the basic segment is projected to expand significantly in the market in the coming years.

- By demographic, the senior citizens segment led the global dental insurance market in 2024.

- By demographic, the adult segment is anticipated to grow with a significant CAGR in the market during the studied years.

Market Overview & Potential

Dental insurance is a form of health coverage dedicated to covering dental care expenses, including preventive, basic, and major procedures. It eases the financial strain of dental treatments, making necessary care more affordable and supporting oral health maintenance. Key features of dental insurance include:

Coverage that generally spans treatments like regular check-ups, cleanings, fillings, extractions, and more advanced procedures such as root canals or crowns. Cost management through reduced out-of-pocket costs enhances access and affordability. Dental plans can be purchased separately or included within broader health insurance policies, often as an add-on or part of outpatient coverage.

Access detailed statistics and historical data in our comprehensive Dental Insurance Market databook: https://www.towardshealthcare.com/download-databook/5471

What is the Growth Potential Responsible for the Growth of the Dental Insurance Markets?

The dental insurance market is mainly influenced by growing awareness of oral health, as more people recognize that oral health issues can impact other parts of the body. This awareness has led to increased demand for preventive and restorative dental treatments, alongside rising treatment costs. An aging population with greater dental needs also contributes to market growth.

Furthermore, technological progress in dentistry, such as digital imaging and minimally invasive procedures, improves care quality and efficiency, potentially raising treatment costs and boosting the need for insurance. The expansion of employer-sponsored dental benefits further supports market growth.

What Are the Growing Trends Associated with the Dental Insurance Market?

Rising Awareness and Costs

- Increasing awareness of overall well-being and escalating the cost of dental treatments fuels the growth of the market.

Shift Towards Preventive Care

- The growing emphasis on preventive dental services and adoption of dental insurance plans and routine checkups, and cleaning fuels the growth.

Technological Advancements

- Advancements such as digital imaging and laser dentistry are in increased adoption for more efficient and accessible care, which further fuels the growth.

Government Initiatives

- Government initiatives and policies for dental benefits and essential health packages contribute to the expansion of the market.

What Is the Growing Challenge in the Dental Insurance Market?

The dental insurance market encounters several significant challenges, such as low consumer awareness of its value, high premium costs, and the complexity of choosing among various plan options, all of which restrict market growth. Furthermore, the difficulty in integrating dental coverage with general health insurance plans and the rising incidence of dental diseases also act as barriers, further impeding market expansion.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Regional Analysis

How Did North America Dominate the Dental Insurance Market in 2024?

North America dominated the global market share by 43% in 2024. The growth of the market in the region is driven by the growing awareness of oral health in the region and the rising dental care costs, which boost the growth of the market. The other factors are the technological advancements, expansion of employer-sponsored plans, individual and family plans, and digital services for streamlining the consumer services drive the growth of the market in the region. The key players like Cigna, MetLife, UnitedHealthcare, Aetna, and other notable companies are the major growth factor in the region due to the innovation in the plans and offerings, which further boosts the growth and expansion of the market in the region.

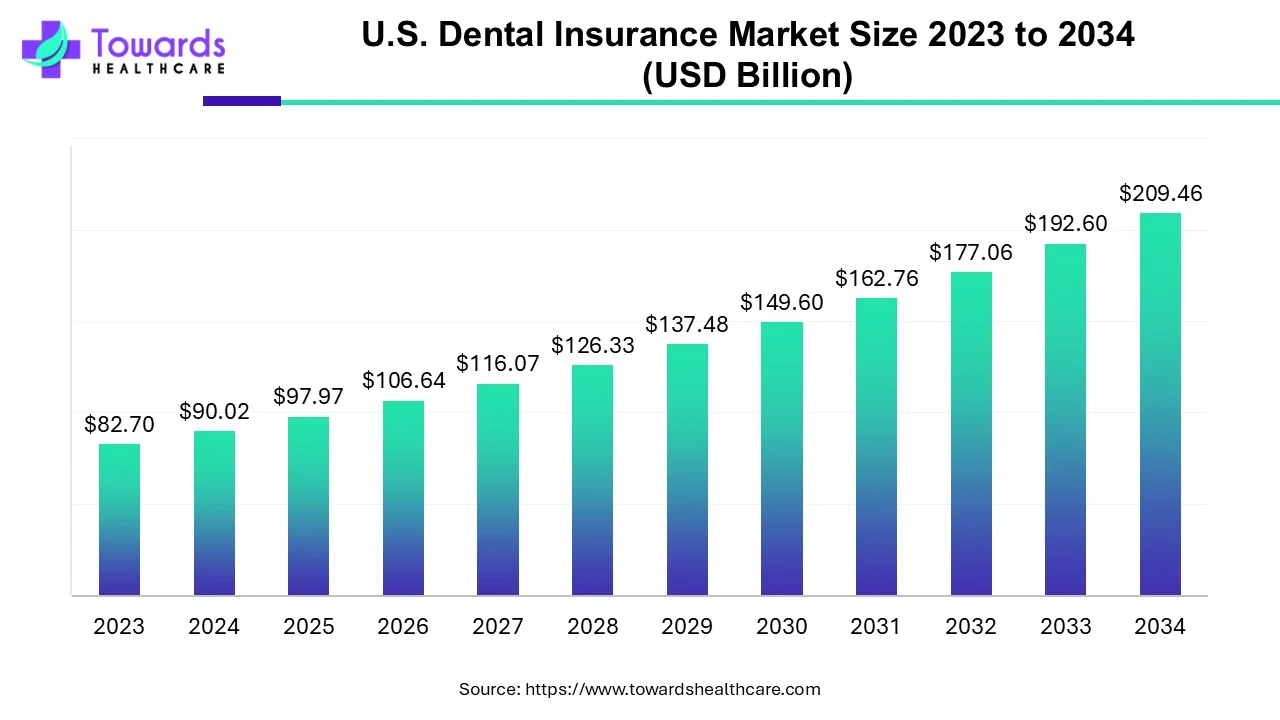

U.S. Dental Insurance Maret Trends

The U.S. dental insurance market size is valued at USD 90.02 billion in 2024 and is expected to grow to USD 97.97 billion in 2025. It is projected to reach approximately USD 209.46 billion by 2034, expanding at a compound annual growth rate (CAGR) of 8.84% from 2025 to 2034. Market growth is driven by the increasing prevalence of dental disorders, supportive government initiatives, and ongoing technological advancements.

Access the full ready-to-use U.S. Dental Insurance Market report with in-depth analysis and strategic forecasts: https://www.towardshealthcare.com/price/5472

In the U.S., over 40% of adults have untreated tooth decay. Dental care is often excluded from health insurance, creating inequities. Rural areas lack providers, and minorities face higher rates of gum disease, largely due to socioeconomic and systemic disparities.

Canada faces challenges despite universal healthcare dental care isn’t covered, leaving 1 in 3 Canadians without regular access. Indigenous communities are disproportionately affected by early childhood caries and tooth loss, compounded by geographic isolation and culturally inadequate oral health services.

What Made Asia Pacific Significantly Grow in The Dental Insurance Market In 2024?

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period. The growth of the market is driven by the rising awareness of oral health, and the increasing disposable income in the region helps in the growth of the market. Additionally, government initiatives through support and partnership for more accessibility and affordability, technological advancements, growing dental disease incidences, and expansion of coverage options are the growing factors that contribute to the growth of the market in the region. DPPOs are a significant revenue-generating segment and are experiencing rapid growth within the market and supporting the expansion of the market in the region.

China’s dental problems are linked to rapid dietary changes, including sugary snacks and drinks. Nearly 70% of children suffer from cavities. Preventive dental visits are rare, and urban-rural disparities persist due to uneven healthcare distribution and limited oral health education.

India’s dental issues stem from widespread tobacco use, high sugar consumption, and low public awareness. Over 85% of adults have periodontal disease. Public dental services are scarce, especially in rural regions, leading to untreated decay, oral cancers, and early tooth loss.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By Coverage

The dental preferred provider organizations (DPPO) segment held a dominant presence in the market in 2024. A Dental Preferred Provider Organization (PPO) is a type of dental insurance plan that offers a robust network of participating dentists who provide services at discounted rates. Enrollees can see in-network providers for the lowest out-of-pocket costs, or visit out-of-network dentists with partial coverage. PPOs offer significant flexibility in choosing providers, broader coverage for restorative and preventive services, and minimal paperwork compared to traditional indemnity plans. Their balance of cost, choice, and simplicity drives widespread adoption in the dental insurance market.

The dental health maintenance organizations (DHMO) segment is predicted to witness significant growth in the market over the forecast period. A Dental Health Maintenance Organization (DHMO) is a type of dental insurance coverage that emphasizes affordable, predictable costs and preventive care. Members are required to choose a primary dentist within the plan’s network and need referrals for specialist services. Typically, DHMOs have lower monthly premiums, no deductibles, and minimal or no co-pays for basic services. This cost-effective, streamlined approach appeals to price-sensitive consumers and supports preventive dental health, driving strong demand for DHMO plans in the dental insurance market.

By Type

The preventive segment held the largest share of the market in 2024. Preventive dental insurance is a key type in the dental insurance market, focusing on coverage for routine care and early intervention to maintain oral health. It typically includes services like regular check-ups, cleanings, fluoride treatments, and X-rays, often with full or high coverage and minimal out-of-pocket costs. By encouraging proactive care, preventive plans help reduce the risk of serious dental problems and costly treatments later. The emphasis on wellness and long-term savings drives strong demand for preventive dental insurance, supporting market growth.

The basic segment is projected to expand significantly in the market in the coming years. Basic dental insurance is an essential type in the dental insurance market, providing coverage for common procedures beyond preventive care. This typically includes services such as simple fillings, tooth extractions, and minor emergency treatments, often with moderate co-pays or cost-sharing. Basic plans help patients manage unexpected dental issues without a significant financial burden, making them a popular choice for individuals seeking affordable, practical coverage. The need for accessible routine treatment options drives demand for basic dental insurance, supporting overall market expansion.

By Demographic

The senior citizens segment led the global dental insurance market in 2024. The senior citizens segment drives, with specialized plans designed to meet their unique oral health needs. As aging increases the risk of dental issues like gum disease, tooth loss, and the need for dentures or implants, tailored coverage becomes essential. Plans for seniors often include preventive, basic, and major restorative services with broader coverage options. The rising elderly population and growing focus on maintaining oral health in later life drive strong demand for dental insurance among senior citizens, supporting market growth.

The adult segment is anticipated to grow with a significant CAGR in the market during the studied years. Adults form a major demographic segment in the dental insurance market, with plans designed to cover a wide range of preventive, basic, and major dental care needs. Coverage typically includes regular check-ups, cleanings, fillings, extractions, and sometimes more extensive procedures like crowns or root canals. Adults often seek dental insurance to manage costs, maintain oral health, and prevent future problems. The growing focus on overall wellness, aesthetic dental treatments, and affordability drives strong demand for dental insurance among adults, supporting market growth.

Elevate your healthcare strategy with Towards Healthcare. Enhance efficiency and drive better outcomes schedule a call today: https://www.towardshealthcare.com/schedule-meeting

Recent Developments in the Dental Insurance Market

- In March 2025, Toothlens, in collaboration with Star Health, launched India's first cashless dental OPD insurance program, which helps access the most affordable dental care.

- In February 2025, the Washington State Dental Association is advocating for changes to dental insurance policies, backing state legislation that seeks to prevent unfair and deceptive practices by insurance companies and ensure that patients have more control over their dental care choices.

Top Companies and Their Contributions to the Dental Insurance Market

| Company | Contributions & Offerings |

| Aetna Inc. | Aetna provides comprehensive dental plans with options for individuals, families, and employers. Their offerings include preventive, basic, and major dental coverage, with a focus on providing affordable access to care. Aetna has a vast network of dental providers. |

| Allianz SE | Allianz offers dental insurance primarily through employer benefits. Their plans often include coverage for preventive care, restorative procedures, and emergency treatments, with a focus on global accessibility and seamless customer service. |

| Ameritas | Ameritas provides customizable dental insurance plans with extensive coverage for preventive, basic, and major services. Their emphasis is on flexible options and strong customer support, with both individual and group policies available. |

| Axa S.A. | AXA provides dental insurance solutions in various international markets. Their policies include comprehensive preventive and restorative care, with an emphasis on providing innovative solutions that align with their global health insurance plans. |

| Canadian Dental Care Plan | This provider offers dental plans tailored specifically to Canadians. Their services include a range of dental coverage options for preventive, diagnostic, and emergency care, focusing on affordability and nationwide access to dental providers. |

| Cigna Dental | Cigna offers dental plans that cater to both individuals and employers, with a focus on preventive care, basic dental procedures, and major services. Cigna’s plans are known for their affordability, extensive provider network, and wellness support. |

| Delta Dental Plans Association | Delta Dental is the largest dental insurance provider in the U.S. They offer a wide variety of individual, family, and group plans. Delta Dental’s network covers a vast array of dental providers and offers plans with excellent preventive care benefits. |

| Guardian Life Insurance Company of America | Guardian offers dental insurance plans with a wide array of options, including PPO and HMO coverage. Their plans are designed to offer high flexibility, with a focus on comprehensive dental care, including preventive, major, and orthodontic treatments. |

| Humana, Inc. | Humana offers affordable dental plans with coverage for preventive care, fillings, crowns, and more. Their policies cater to both individuals and employers and include options for customizable coverage and nationwide access to dental care. |

| MetLife Services & Solutions LLC | MetLife provides dental plans with both individual and group options. Their plans include preventive care, basic, and major dental procedures. They also offer enhanced benefits for orthodontics and a wide provider network for easy access to care. |

Browse More Insights of Towards Healthcare:

The global dental tourism market was valued at USD 8.55 billion in 2024, is expected to grow to USD 10.43 billion in 2025, and is projected to reach approximately USD 62.65 billion by 2034, expanding at a CAGR of 22.04% from 2025 to 2034.

The global dental services organization (DSO) market is estimated at USD 163.93 billion in 2024, rising to USD 192.83 billion in 2025, and anticipated to reach around USD 835.87 billion by 2034, growing at a CAGR of 17.65% between 2025 and 2034.

The U.S. dental services organization market stands at USD 37.9 billion in 2024, projected to reach USD 44.7 billion in 2025 and grow further to approximately USD 196.5 billion by 2034, registering a CAGR of 17.9% from 2025 to 2034.

The global dental equipment market is valued at USD 11.95 billion in 2024, set to reach USD 12.71 billion in 2025, and forecasted to grow to around USD 22.1 billion by 2034, at a CAGR of 6.34% between 2025 and 2034.

The global oral iron supplements market is witnessing substantial growth, with revenues expected to rise significantly reaching several hundred million dollars by the end of the 2024 to 2034 forecast period.

The global skincare market is projected at USD 115.69 billion in 2024, increasing to USD 123.64 billion in 2025, and expected to reach around USD 224.83 billion by 2034, expanding at a CAGR of 6.87% from 2025 to 2034.

The global skin repair market is estimated at USD 85 billion in 2024, growing to USD 90.58 billion in 2025, and projected to reach approximately USD 160.46 billion by 2034, expanding at a CAGR of 6.56% over the forecast period.

The global personalized skincare products market is valued at USD 30.63 billion in 2024, set to reach USD 33.09 billion in 2025, and is anticipated to grow to USD 66.37 billion by 2034, advancing at a CAGR of 8.04% from 2025 to 2034.

The global skin repair dressing market was valued at USD 8.06 billion in 2023 and is expected to grow to USD 16.45 billion by 2034, reflecting a CAGR of 6.7% from 2024 to 2034.

The global direct oral anticoagulants (DOACs) market was estimated at USD 43.9 billion in 2023 and is projected to reach USD 102.36 billion by 2034, growing at a CAGR of 8% over the forecast period from 2024 to 2034.

Key Players in the Dental Insurance Market

- Aetna Inc.

- Allianz SE

- Ameritass

- Axa S.A.

- Canadian Dental Care Plan

- Cigna Dental

- Delta Dental Plans Association

- Guardian Life Insurance Company of America

- Humana, Inc.

- MetLife Services & Solutions LLC

- Spirit Dental Insurance

- TATA AIG

- UnitedHealthcare

Segments Covered in The Report

By Coverage

- Dental Preferred Provider Organizations (DPPO)

- Dental Health Maintenance Organizations (DHMO)

- Dental Indemnity Plans

- Others

By Type

- Preventive

- Basic

- Major

By Demographic

- Senior Citizens

- Adults

- Minors

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

To invest in our premium strategic solution and customized market report options, click here: https://www.towardshealthcare.com/price/5471

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.